Reordering checks through Chase Com has become an essential task for individuals seeking seamless banking experiences. Whether you're running a small business or managing personal finances, having a reliable method to reorder checks is crucial. In this article, we will explore the ins and outs of Chase Com reorder checks, providing you with step-by-step guidance, tips, and insights to make the process as smooth as possible.

With the rise of digital banking solutions, Chase has introduced user-friendly tools and platforms that simplify the process of reordering checks. This ensures customers can manage their financial needs efficiently without unnecessary complications. Understanding how to navigate Chase's system for reordering checks will save you time and reduce stress.

This article will delve into various aspects of Chase Com reorder checks, including the importance of maintaining check supplies, the step-by-step process, common issues, and how to resolve them. By the end of this guide, you'll be equipped with the knowledge to manage your check orders effectively and confidently.

Read also:Starlight Vote Revolutionizing The Way You Cast Your Vote

Table of Contents:

- Biography (if applicable)

- The Importance of Reordering Checks

- Step-by-Step Guide to Reorder Checks

- Exploring Digital Options for Reordering Checks

- Understanding the Costs Involved

- Tips for Efficient Check Management

- Common Issues and Solutions

- Security Measures for Ordering Checks

- Alternative Methods for Ordering Checks

- Frequently Asked Questions

- Conclusion

The Importance of Reordering Checks

Reordering checks may seem like a mundane task, but it plays a critical role in maintaining financial stability and organization. For businesses, having an adequate supply of checks ensures timely payments to vendors, employees, and other stakeholders. Similarly, individuals rely on checks for various transactions, including rent payments, utility bills, and charitable donations.

When you run out of checks, it can lead to delays in payments, which may result in late fees, damaged credit scores, or strained relationships with creditors. Therefore, staying proactive about reordering checks is vital for both personal and professional financial health.

Why Chase Com?

Chase Com offers a secure and efficient platform for reordering checks. The platform integrates seamlessly with your Chase account, allowing you to access your check history, view available balances, and customize your order effortlessly. This convenience ensures that you can focus on more pressing financial matters without worrying about running out of checks.

Step-by-Step Guide to Reorder Checks

Reordering checks through Chase Com is a straightforward process. Below is a detailed step-by-step guide to help you navigate the system effectively:

1. Log in to Your Chase Account

Begin by logging into your Chase account using your credentials. Ensure that your login information is secure and up-to-date to prevent unauthorized access.

Read also:Aidan Gallagher Height Unveiling The Truth About The Rising Star

2. Navigate to the "Order Checks" Section

Once logged in, locate the "Order Checks" option in your account dashboard. This section is typically found under the "Services" or "Account Management" tab.

3. Customize Your Order

Chase offers a variety of check designs and formats. You can choose from standard checks, duplicate checks, or personalized designs that suit your preferences. Additionally, you can specify the number of checks you need and any special features, such as check stubs or carbon copies.

4. Review and Confirm Your Order

Before finalizing your order, review all the details to ensure accuracy. Check the quantity, design, and delivery options. Once everything is correct, proceed to confirm your order.

Exploring Digital Options for Reordering Checks

In today's digital age, Chase Com provides multiple avenues for reordering checks. Besides the traditional online platform, you can also use the Chase mobile app to manage your check orders. The mobile app offers the same features as the web platform, allowing you to reorder checks on the go.

Benefits of Digital Ordering:

- Convenience: Access your account anytime, anywhere.

- Speed: Orders can be processed faster compared to traditional methods.

- Security: Enhanced encryption and authentication protocols protect your information.

Using the Chase Mobile App

The Chase mobile app simplifies the process of reordering checks by offering a user-friendly interface. You can easily navigate through the app's features to place your order, track its status, and receive notifications upon delivery.

Understanding the Costs Involved

When reordering checks through Chase Com, it's essential to understand the associated costs. While Chase does not charge additional fees for using their platform, the cost of checks themselves varies depending on the type and quantity ordered.

Typical Costs:

- Standard Checks: $15-$25 per pack

- Personalized Checks: $25-$40 per pack

- Duplicate Checks: $30-$50 per pack

It's important to note that prices may fluctuate based on promotions, discounts, or seasonal offers. Always check Chase's official website or contact customer service for the most up-to-date pricing information.

Tips for Efficient Check Management

Managing checks efficiently can save you time and money. Here are some practical tips to help you streamline the process:

- Monitor your check usage regularly to anticipate when you'll need to reorder.

- Set reminders in your calendar to reorder checks before you run out.

- Choose a check design that suits your needs and preferences.

- Consider ordering duplicate checks for better record-keeping.

- Store your checks in a secure location to prevent theft or loss.

Common Issues and Solutions

While reordering checks through Chase Com is generally hassle-free, some users may encounter issues. Below are common problems and their solutions:

Issue 1: Unable to Access the "Order Checks" Section

Solution: Ensure that you are logged into the correct account and that your account has the necessary permissions to order checks. If the issue persists, contact Chase customer service for assistance.

Issue 2: Delayed Delivery

Solution: Check the status of your order through Chase Com or the mobile app. If the delay continues, reach out to Chase's customer support team for clarification.

Issue 3: Incorrect Order Details

Solution: Contact Chase immediately to report the error. They may be able to cancel or modify your order before it is processed.

Security Measures for Ordering Checks

Security is a top priority when ordering checks online. Chase Com employs advanced encryption and authentication protocols to protect your personal and financial information. However, there are additional steps you can take to enhance security:

- Create strong, unique passwords for your Chase account.

- Enable two-factor authentication for added protection.

- Avoid accessing your account on public Wi-Fi networks.

- Regularly monitor your account for suspicious activity.

Alternative Methods for Ordering Checks

While Chase Com is a convenient option for reordering checks, there are alternative methods you can consider:

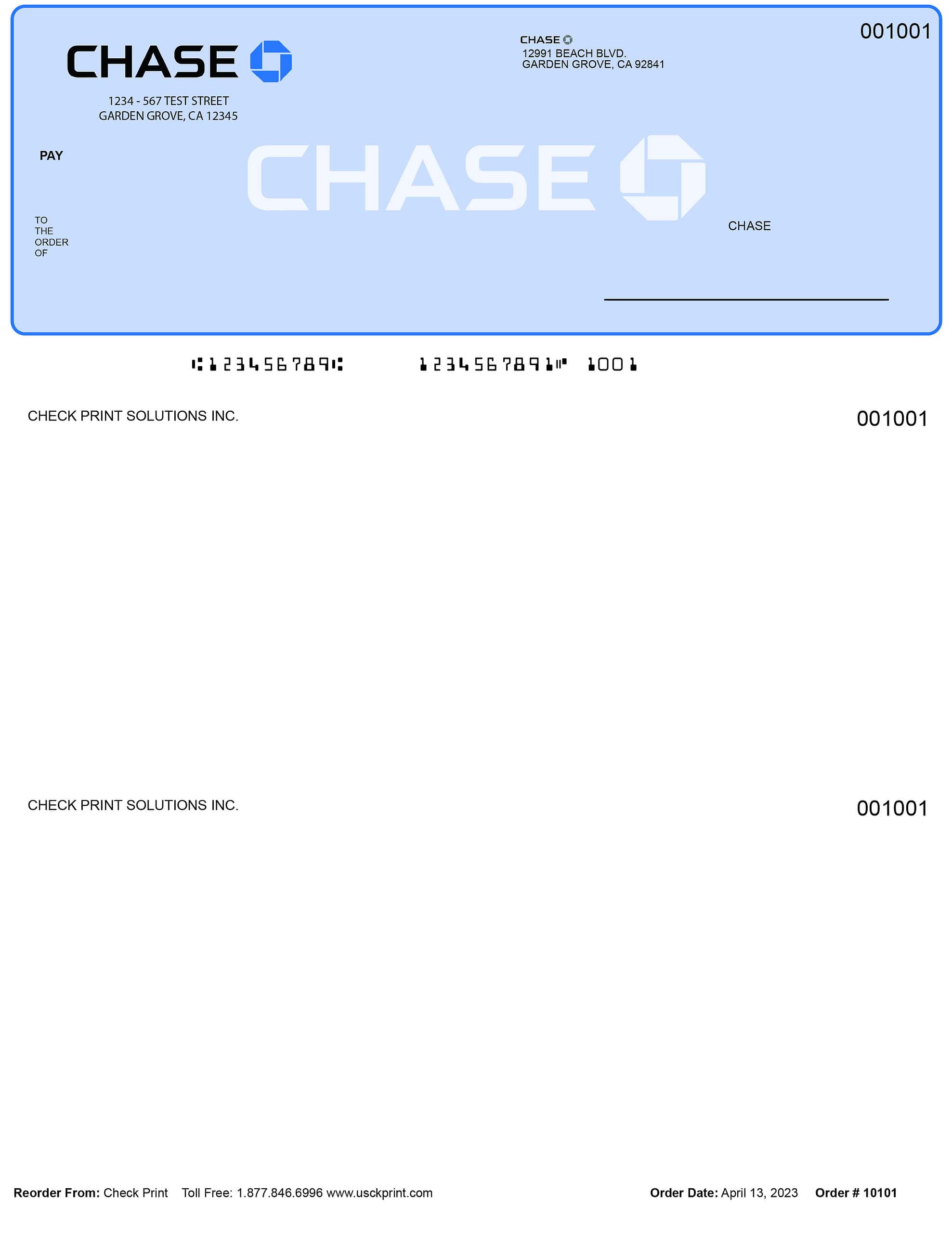

1. Third-Party Check Printing Services

Companies like Checks Unlimited and Deluxe offer competitive pricing and customizable options for ordering checks. However, ensure that these services are authorized by your bank to prevent compatibility issues.

2. In-Person Ordering

If you prefer a face-to-face interaction, you can visit a Chase branch to reorder checks. This method may take longer but provides an opportunity to discuss any concerns with a bank representative.

Frequently Asked Questions

Here are answers to some common questions about reordering checks through Chase Com:

Q1: How long does it take to receive my checks?

A: Delivery times vary depending on your location and the shipping method chosen. Standard delivery usually takes 7-10 business days, while expedited shipping can arrive within 3-5 business days.

Q2: Can I cancel my order after placing it?

A: Yes, you can cancel your order as long as it hasn't been processed. Contact Chase customer service immediately to request cancellation.

Q3: Are there any restrictions on the number of checks I can order?

A: Chase does not impose strict limits on the number of checks you can order. However, excessive orders may trigger fraud alerts, so it's best to order only what you need.

Conclusion

Reordering checks through Chase Com is a simple and secure process that ensures you have the necessary tools to manage your finances effectively. By following the steps outlined in this guide, you can streamline the ordering process, avoid common pitfalls, and maintain a steady supply of checks.

We encourage you to take advantage of Chase's digital platforms and security measures to enhance your banking experience. Don't hesitate to reach out to Chase customer service if you encounter any issues or have further questions.

Feel free to share this article with others who may find it helpful. Your feedback is valuable, so please leave a comment or suggestion below. For more insightful content, explore our other articles on personal finance and banking solutions.